Financial inclusion, key to empower mothers

01.03.24

UN New York - CSW68 - Our written statement to the 2024 Commission on the Status of Women focuses on financial inclusion as a means of accelerating the empowerment of women, so that they can fully play their role in advancing social and economic development - a key factor in the fight against women’s poverty.

The following is the full text of our written statement.

Globally, women disproportionately experience poverty, notably as a result of their unequal share of unpaid domestic and care work, which limits their opportunities for educational attainment or employment outside the home – all the more so when they are mothers. In addition, women often have more limited access to asset and land ownership, including through inheritance, and more generally suffer from a lack of control over economic resources.

Many women therefore remain dependent on their husbands. Still too many have no control over household spending on major purchases, or are not consulted about the way their own earnings are spent. This places them in a highly vulnerable position, particularly in cases of domestic violence.

Whatever type of income women rely upon – wages, government transfers or pensions, earnings from their own businesses – financial inclusion provides them with the tools for managing their finances, accumulating assets, mitigating financial risks, generating additional income, and fully participating in the economy.

In concrete terms, financial inclusion supports the economic empowerment of women. Its benefits are numerous:

- It promotes their financial independence and their autonomy, which in turn strengthens their self-esteem and self-confidence

- It gives them greater financial stability and security, including through savings and insurance services

- It enables them to make their own decisions regarding the use of their financial resources

- It supports them in setting up a business, thereby promoting entrepreneurship and self-employment.

What’s more, mothers’ financial inclusion also has beneficial effects on the household, especially children, and more broadly on communities. An empowered mother means children have better access to nutrition, medical care and education, triggering a virtuous circle: these healthier, better-educated children will later be able to contribute to their communities and the economy.

Financial inclusion takes many forms. It includes access to a bank account with a formal sector institution, access to financial services such as savings or the ability to take out a loan, but also access to micro-credit and mobile financial services, as well as financial education.

Access to a bank account

According to the World Bank, more than one in four women still have no access to a bank account. While this situation is progressing overall, there are significant disparities depending on geography and the level of development. In sub-Saharan Africa, more than one in two women have no access to a bank account, while in the Middle East and North Africa, the figure is much higher at 58%. It should also be pointed out that data is lacking for many low-income countries, which makes it impossible to have a precise and reliable account of the situation.

Access to a bank account is a prerequisite for financial inclusion: it enables women first and foremost to receive payments: wages, payments from government bodies, public or private institutions, to keep their financial resources in a safe place and have control over these resources. It also allows them to access financial services such as savings, credit, etc. In this way, they can gain autonomy and make their own decisions about spending, investing and saving for themselves but also for their children and their families.

Access to mobile finance

According to the World Bank, data from Sub-Saharan Africa shows evidence that mobile money accounts are increasing financial inclusion for women. Access to mobile money accounts, which has accelerated since the Covid 19 pandemic, like other digital uses, is progressing much faster among Sub-Saharan African women than the possession of a traditional bank account in a financial institution.

This enables women to benefit from financial services via a simple telephone, the use of which has also grown considerably in recent years. Getting a mobile money account is less expensive than opening an account with a financial institution, saves critical time (no need to travel to the bank branch, which is often far away) and is simpler to set up.

Access to micro-credit

Over 80% of micro-credit beneficiaries worldwide are women, often mothers. Access to micro-credit enables many of them to create their own business, generate income and improve their standard of living and that of their families.

Financial literacy

Women’s access to bank accounts, mobile finance, financial services and micro-credit must be accompanied by financial education. Financial literacy is a prerequisite for increasing the positive impact of financial inclusion in the development of women and their families.

Financial literacy can be defined as the ability to understand and effectively use financial concepts and tools to make informed decisions and ultimately achieve well-being. It helps women establish a budget, make smart investments, save for retirement, and build resilience against economic shocks, like the one imposed by the Covid 19 pandemic. It is also important to make women aware of the dangers of credit, in particular high-interest consumer loans, which could lead to a spiral of debts.

Instead of living day-to-day thereby incurring higher costs, financially literate women are able to plan strategically for the long term. In particular, they know the importance of savings, which are crucial to absorb financial shocks linked to unexpected events. As such, a lack of financial knowledge prevents women from accumulating wealth and ultimately stops them from securing their future.

Our recommendations

To strengthen the financial inclusion of women, including mothers, Make Mothers Matter calls on Member States to:

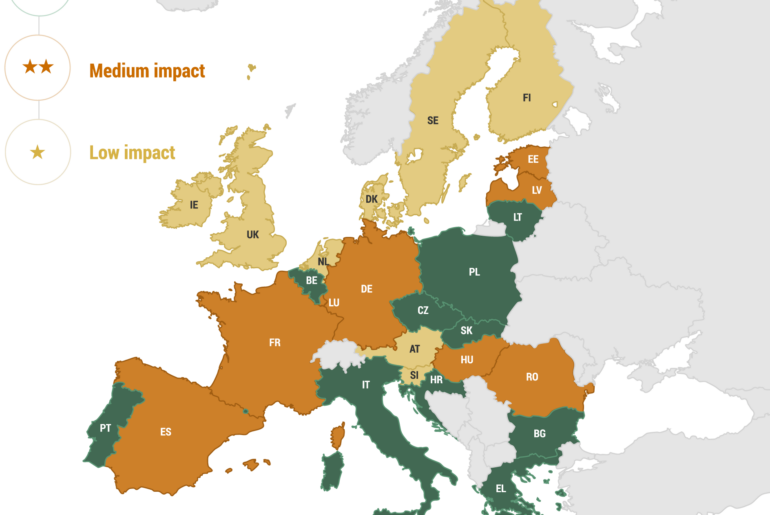

- Build up or pursue national financial inclusion strategies, and include a gender perspective. Globally, more than 50 countries have already implemented such strategies to help coordinate national action, mostly in Asia and Africa. Results indicate that countries that adopt national strategies accelerate progress in financial inclusion and have economies which grow faster than less inclusive countries. However, for financial inclusion to work for women, their specific needs and constraints – in particular in relation to their care responsibilities, which limits their time and mobility – must be taken into account

- Improve women’s access to financial tools:

– Financial education: encourage and facilitate the development of and access to programs, mentorship, workshops and online resources. Financial education should already start at school

– Micro-credit: create/strengthen a legal framework and control bodies for the practices of micro-credit organizations, so that women do not become overburdened by debts

– Mobile finance: promote access to cell phones for the poorest, especially mothers who are always short of time. For example, in Sub-Saharan Africa, almost one woman in 4 (23%) does not have her own cell phone. Giving them access to a cell phone can be achieved by granting subsidies to companies manufacturing low-cost phones, developing leasing or phone rental systems, or providing subsidies for women to buy a phone

– Access to a bank account: put in place government policies that tackle access constraints. The main reasons preventing women opening a bank account are the cost, the distance from the nearest financial institution and the documentation required. For example, in Sub-Saharan Africa, 16% of adults do not have an ID card, which is required to open a bank account. Policies should aim to encourage financial institutions to reduce the cost of opening an account, simplify procedures and develop the digitisation of banking operations to benefit the poorest, particularly women

– Access to financial services: encourage the creation of secure services that specifically respond to the constraints and meet the needs of women, such as loans for ‘mompreneurs’ - Develop age and gender disaggregated indicators on access, use, quality and impact of financial inclusion on social and economic development. Such indicators will make it possible to:

– gain precise, fact-based knowledge of financial inclusion and measure its effectiveness for women

– monitor and evaluate the financing of financial inclusion projects

Financial inclusion, including financial literacy, must be a priority for any strategy that addresses women’s poverty and promotes women’s economic empowerment.

At the same time and as part of tackling the overall problem, governments must take into account the root cause of women’s specific vulnerability to poverty and exclusion, namely their disproportionate share of unpaid care and domestic work and responsibilities. The two issues are essentially linked.

MMM Statement for download: as submitted with references – as a UN document (ref. E/CN.6/2024/NGO/153)

The 68th UN Commission on the Status of Women takes place from 11 to 22 March 2024 at the UN headquarters in New York. This year’s priority theme: “Accelerating the achievement of gender equality and the empowerment of all women and girls by addressing poverty and strengthening institutions and financing with a gender perspective”.

The New EU Gender Equality Roadmap : A Call for Inclusion of Mothers

04.03.25

The European Commission’s initiative on a new Gender Equality Roadmap post-2025, marks a significant step forward in addressing gender disparities across the European Union. Make Mothers Matter (MMM

Breaking the Cycle: Gender Equality as a Path to Better Mental Health

18.03.25

The Council of the European Union has taken a decisive step in recognising the vital connection between gender equality and mental health.

Europe Must Listen to Mothers: Our landmark report heads to the European Parliament

28.08.25

On 22 September 2025, the voices of mothers will take centre stage in Brussels. For the first time, Make Mothers Matter (MMM) will present its State of Motherhood in Europe